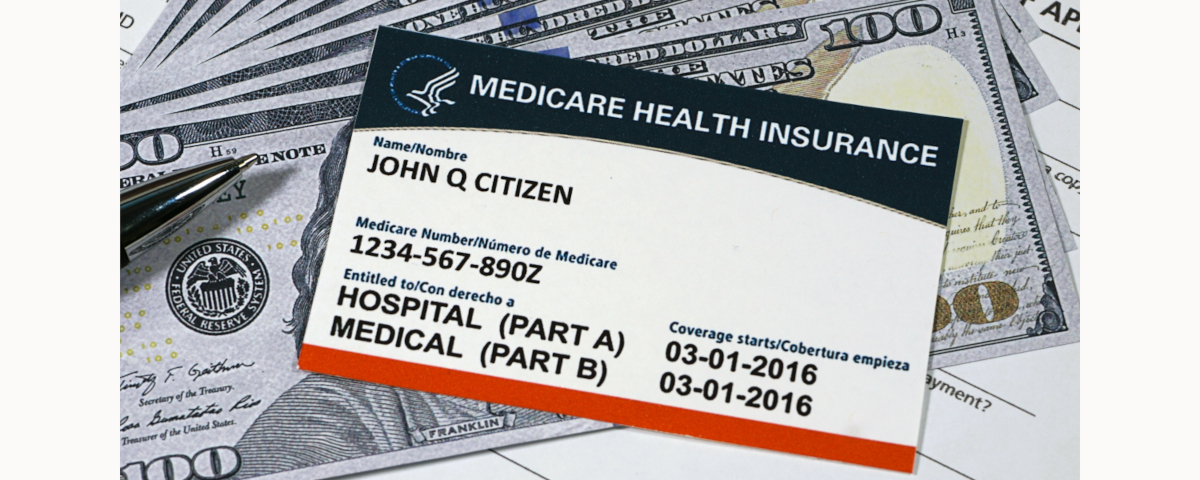

Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

Medicare numbers are our gateway to vital healthcare services. But just like your Social Security number, they're confidential and require us to protect them since fraudsters are always seeking ways to exploit this information. So, it's important to be informed and vigilant in safeguarding your Medicare number.

Why Your Medicare Number Matters

Sharing your Medicare number carelessly can lead to several problems that can cause much more than just a headache:

- Identity Theft: A stolen number can be used to submit fake medical bills in your name, drain your Medicare benefits, and potentially harm your credit score.

- Scams: Beware of unsolicited calls, emails, or visits from people claiming to represent Medicare. Legitimate organizations won't pressure you to share your number over the phone. If you're unsure, hang up and find the verified contact information yourself.

Common Medicare Scams to Watch Out For

The Social Security Administration shows that Medicare fraud can cost Americans more than $60 billion a year. Some experts proclaim that the number may exceed $100 billion.

Medicare fraud ranges from relatively simple schemes to complex, highly organized crime rings. Here are the two most common forms of fraud beneficiaries are likely to face:

- Fake Equipment Bills: Scammers might offer "free" medical equipment and then bill Medicare for unnecessary items in your name.

- Phony Doctor Visits: They could fabricate doctor visits and bill Medicare for services you never received.

Sharing your number could also allow someone to:

- Change Your Plan: Without your knowledge, they might switch you to a Medicare plan with different benefits or higher costs.

- Limit Your Care: They could even restrict your access to specific doctors or specialists within your plan.

Protecting Your Medicare Number

Just like social security numbers, there are a few steps you can take to ensure your Medicare number remains safe:

- Be Cautious: Only provide or share your number with trusted sources like your doctor's office or a verified Medicare representative.

- Review Your Medicare Statements: Look for suspicious charges or services you never received.

- Shred Old Documents: Destroy any documents containing your Medicare number before throwing them away.

What to Do If You Suspect Fraud

If you suspect someone is using your Medicare number illegally, contact Medicare directly at 1-800-MEDICARE (1-800-633-4227) or visit their website at https://www.medicare.gov/.

By staying informed and following these tips, you can protect your Medicare number, your benefits, and your peace of mind.

Featured Blogs

- Would You Bet $7,000 on Your Health This Year?

- Breathe Easy: The Surprising Benefits of Houseplants in Your Home

- Understanding the Unique Challenge

- Term Insurance: A Smart Way to Secure Your Family’s Future

- The Ultimate Spring Bucket List: Fun Activities to Enjoy the Season

- Spring into Wellness: How to Boost Your Health and Energy this Season

- Top 5 Common Insurance Myths and the Truth Behind Them

- Understanding Universal Life Insurance: Is It Right for You?

- Understanding Your Insurance Options

- The Hidden Benefits of Health Insurance You May Not Be Using

- Questions to Ask Before Choosing an Insurance Policy

- The Impact of New Technology on Insurance

- Healthy Living on a Budget: How Insurance Can Help You Save on Wellness Expenses

- Protecting Your Investments: The Role of Insurance in Wealth Management

- Understanding Co-Pays vs. Coinsurance: Making Sense of Your Health Insurance Costs

- Insurance Myth Busters: Debunking Common Misconceptions about Coverage

- Understanding Your Health Insurance Deductible: Tips for Making the Most of Your Coverage

- The Evolution of Insurance: Trends and Innovations Shaping the Industry

- Healthy Habits for the Summer: Tips for Utilizing Your Health Insurance Benefits

- The Future of Work

- Emergency Preparedness: How Insurance Can Provide Peace of Mind During Crises

- Managing Chronic Conditions: How Health Insurance Can Help You Stay Healthy All Year Round

- Navigating Insurance Renewals: Tips for Reviewing Your Policies

- The Importance of Preventive Care Coverage: How Your Health Insurance can Save You Money in the Long Run

- Easy & Creative Ideas to Refresh Your Home for Summer

- Health Insurance 101: A Guide for Recent Graduates

- How Milestones Can Affect Your Coverage Needs

- Safeguard Your Medicare Number: A Guide to Avoiding Fraud and Protecting Your Benefits

- What is Hospital Indemnity Insurance?

- What Is a Medicaid Gap in Tampa?

- Embrace Strong Bones: Tips for Lifelong Health

- How to Improve the Air Quality in Your Home

- How to Avoid Muscle Loss as You Age

- The Rise of Urban Gardening

- Art of Mindful Eating: Transform Your Meals, Transform Your Life

- Fueling Your Mind with Brain-Boosting Foods

- 5 Simple Ways to Boost Your Immune System (and 1 unusual way)

- Embracing Our Roles: Renewing Our Commitment to Sustainable Living

- Tips for a Stress-Free Tax Season Experience

- Spring fitness ideas

- Inspirational women who make the world a better place

- Creating a Positive Start to Your Day

- Spring Forward: Adjusting Your Routine for Daylight Saving Time

- Gratitude - Key to a Positive Mindset

- Adopting a Holistic Wellness Approach to a Healthier You

- 3 Common Sense Things People Should Know

- What Is Medicaid in Tampa

- Beginner Tips on How to Find the Best Home Healthcare Insurance in Tampa

- 10 Tips for Choosing the Best Medicare Supplement Provider in Tampa

- 10 Things You Should Ask Before Choosing a Medicare Plan in Tampa

- 7 Disadvantages of Not Getting Long-term Care Insurance in Tampa

- Digital Detox: A Healthy You in a Hyperconnected World

- Top 6 Medicare Questions Answered by Experts

- Is Obamacare Different from Medicare?

- Are Medicare Supplement Plans In Tampa, FL the Best for You?

- How to Choose the Best Medicare Part D Plan in Tampa, Florida

- 10 Benefits of Hospital Indemnity Insurance in Tampa, Florida

- 5 Tips On How To Stay Free Of Medicare Penalties in Tampa, Florida

- Does Medicare Insurance Cover Surgery In Tampa?

- Reasons to Get Home Healthcare Insurance in Tampa with AHG Brokers

- What Are the Benefits of Medicare Advantage Plans?

- What Is Medicare Part D and How Can It Make Your Life Easier?

- Is Health Insurance Safe?

- What are the Steps for Getting Health Insurance

- What Is Medicare Insurance?

- What Is the Process for Long-Term Care Insurance Claims

- The Importance of Home Healthcare Insurance

- Medicare Advantage Prescription Drug Coverage: What You Should Know

- The Pros and Cons of Medicare Advantage

- Decoding Healthcare Insurance: A Comprehensive Guide for Beginners

- Understanding Medicare Supplement: A Comprehensive Guide

- Tampa’s Top Health Insurance Brokers: Guiding You Towards the Best Coverage

- Choosing the Right Health Insurance Agent in Tampa: Tips and Advice

- Understanding the Different Types of Disability Insurance

- Protecting Your Health and Wealth: The Role of Health Insurance

- Why Health Insurance Is Essential for Everyone: Understanding Your Options

- How to Choose the Right Health Insurance Plan for Your Needs

- What You Must Know: Disability Insurance Claims

- Medicare Insurance: What It Is and Who It’s For

- What You Must Understand about Health Insurance